Smart Tips About How To Reduce Property Taxes In Ny

Before filing with the tax commission, review your notice of property value.

How to reduce property taxes in ny. This easy guide will help to get you started: There are a few ways to lower property taxes. How can i lower my property taxes in ny?

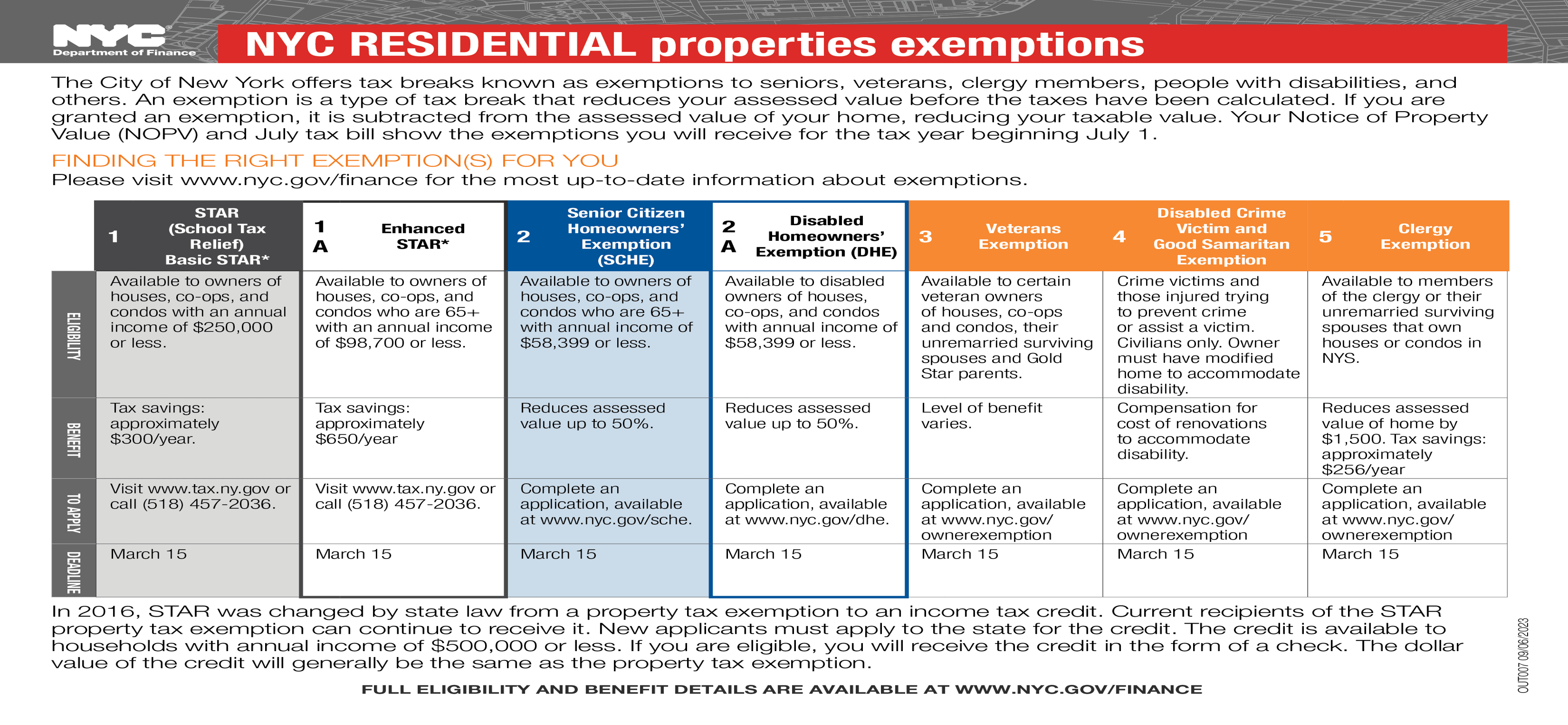

Avoid automatically looking at the listings. Efforts to lower personal income tax rates in new york have been beneficial, but now we must focus on reducing property taxes. New york state law allows local governments and school districts to give qualifying senior citizens up to a 50% reduction in the assessed value of their residential.

As an alternative, counties recommend the state eliminate. File the grievance form with the assessor or the board of assessment review (bar) in your city or town. Determine your starting assessed value.

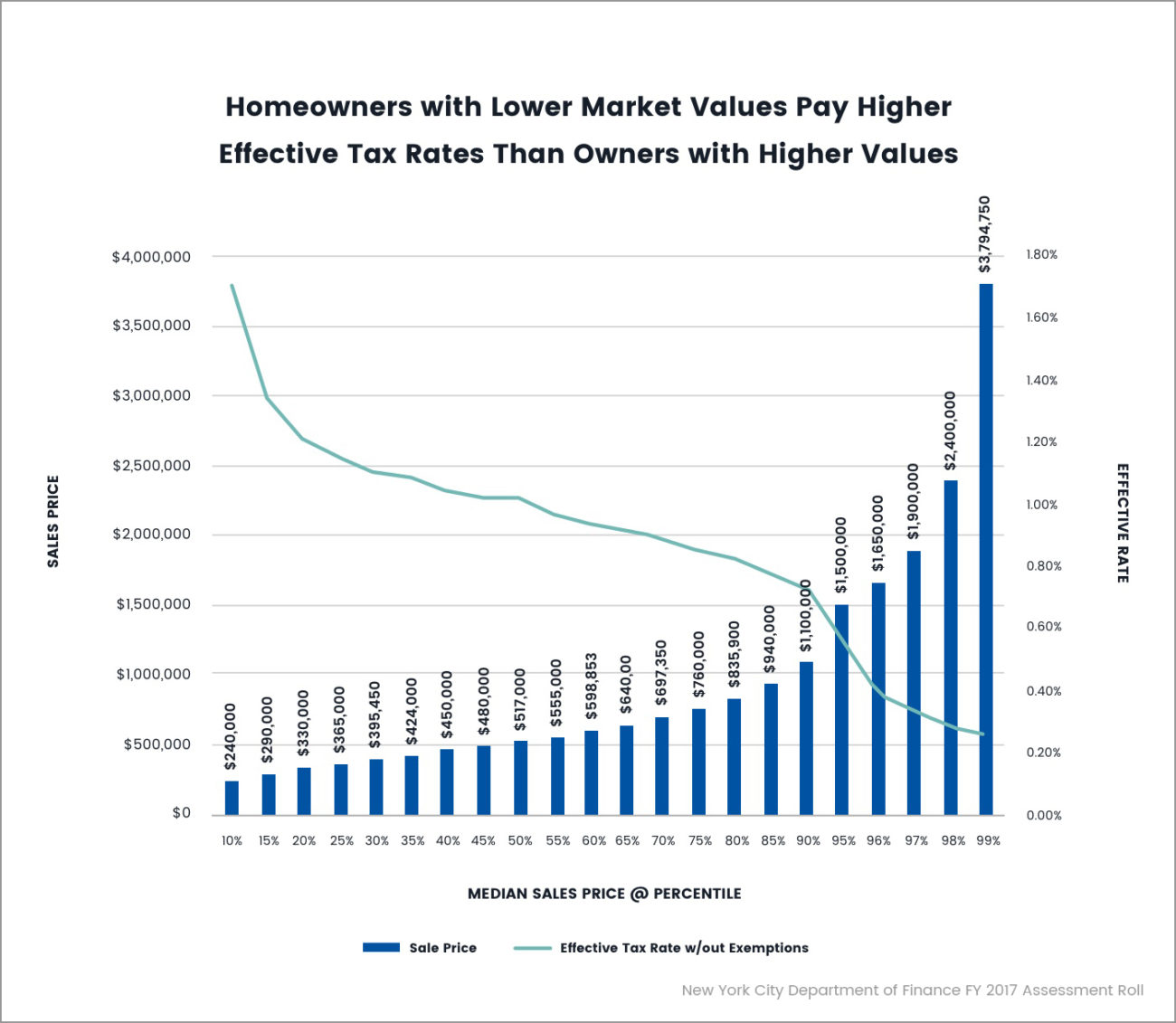

But it is important to note that the assessed value of your property is not always going to. The best ways to lower your property taxes if you’re worried that your tax bill will be too high, there are some strategies you can try to lower it: Walk alongside the assessor while he or she.

While new york isn’t considered a state with low property taxes, there are ways you can lower them. One way is to get a homestead exemption. If your property is located in a village that assesses property, you will have.

To be eligible for sche, you must be 65 or. During the period march 1 to march 15th, the nyc tax commission allows you to adjust your taxes by visiting its website. Another way is to appeal your property taxes.

You can also try to get a senior. The senior citizen homeowners' exemption (sche) provides a reduction of 5 to 50% on new york city's real property tax to seniors age 65 and older. If possible, get the actual selling prices of the homes.

You can interact with the nyc tax commission online to request an adjustment to your taxes, and this can be done annually between march 1 and. Tom suozzi says he would loosen state regulations on counties and direct more funding to struggling. One method that can reduce your tax bill is applying for a tax exemption, such as the.